Related News

BTN Prospera Unlocking Your Potential

16 May 2024

BTN Sayangkan Demo Anarkis

29 Apr 2024

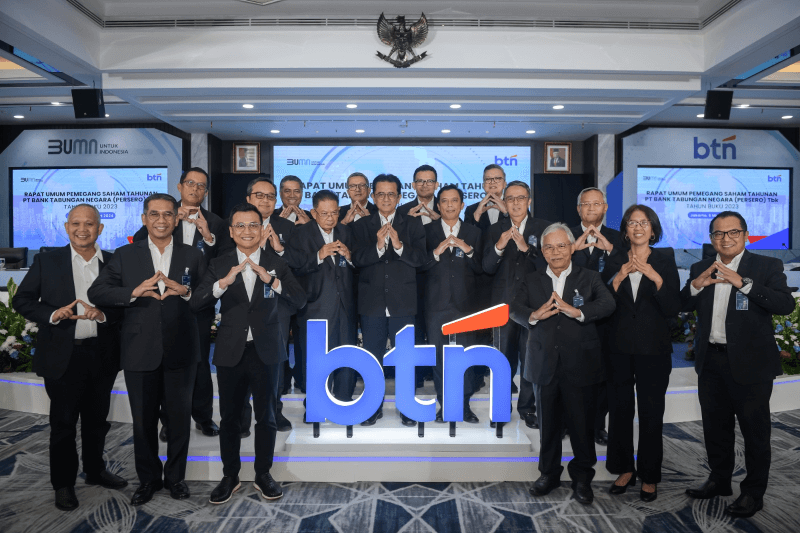

RUPST BTN Bagikan Dividen Rp 700,19 Miliar

07 Mar 2024

Announcement of Changes in Brand and Logo of PT Bank Tabungan Negara (Persero) Tbk

03 Mar 2024

Free Annual Fee

Free Annual Fee

Fast Approval

Fast Approval

Attractive Promotion

Attractive Promotion

Bigger limits

Bigger limits

Airport Lounge Facility

Airport Lounge Facility

Bigger Reward Point

Bigger Reward Point